Enjoy these exclusive benefits with your Rapid Rewards Premier Business Credit Card with no foreign transaction fees:

Get automatic check-in to enjoy a better boarding position and earlier access to overhead bins.

25% back on inflight purchases footnote reference *

Boost of 10,000 Companion Pass ® qualifying points every year footnote reference *

Earn 1,500 tier qualifying points (TQPs) toward A-List status for every $5,000 spent in purchases annually. footnote reference *

When you use your Rapid Rewards Credit Card to transfer points to another Rapid Rewards Member, fees associated with the transfer will be reimbursed–up to $500 in statement credits per anniversary year.

Plus earn unlimited points:6,000 anniversary points footnote reference *

3 points per $1 spent footnote reference *

2 points per $1 spent footnote reference *

2 points per $1 spent footnote reference *

1 point per $1 spent footnote reference *

Employee Cards footnote reference *

Not a Premier Business Cardmember?

Call 1-800-346-5538 to request an upgrade.

Enter your approximate monthly spend in each category.

start points calculator table points tile row 1 column 1on Southwest purchases

3X points input points tile row 1 column 2on local transit and commuting, including rideshare

2X points input points tile row 2 column 1on Rapid Rewards hotel and car rental partners

2X points input points tile row 2 column 2on all other purchases

1X point input points tile row 2 column 3each year after your

Cardmember anniversary

points

per year.

![]()

Southwest Airlines flights–Redeem your points for flights to over 90 destinations and enjoy all you love about flying Southwest Airlines.

opens overlay Search for flights

![]()

Hotel stays and car rentals–Redeem at thousands of hotels and car rental agencies from all over the country through the More Rewards platform.

Rapid Rewards Access Events–Use your points to experience unique events especially curated for Cardmembers.

![]()

Gift cards–Choose from some of your favorite retailers and redeem for as few as 3,000 points.

![]()

Merchandise–Shop for electronics, golf supplies, luggage, travel accessories, and more.

![]()

International flights on 50+ global carriers–Use your Rapid Rewards points for flights.

You can earn 20,000 bonus points for each friend who gets any Southwest Rapid Rewards ® Credit Card when you use the link.

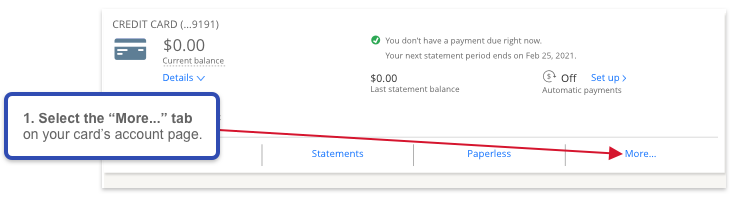

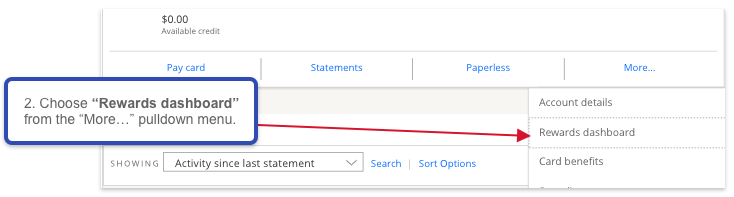

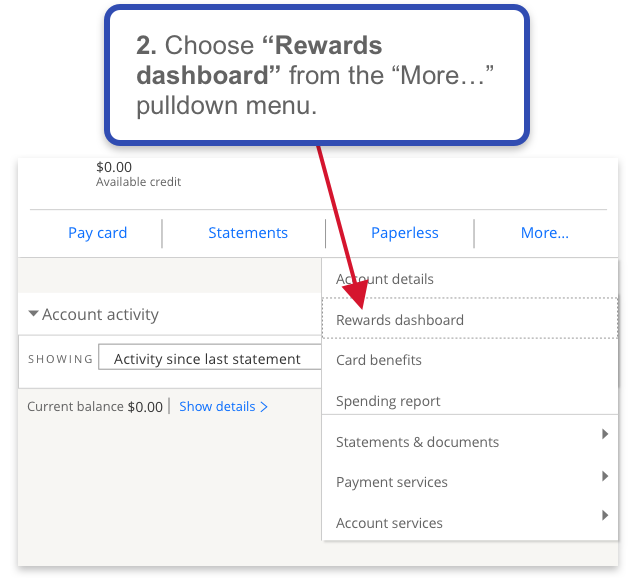

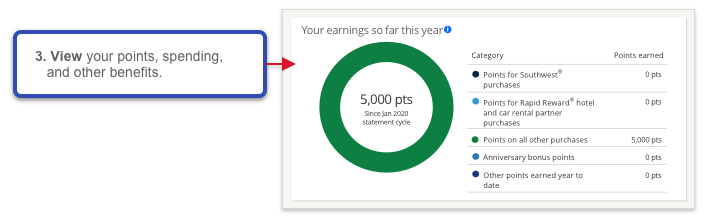

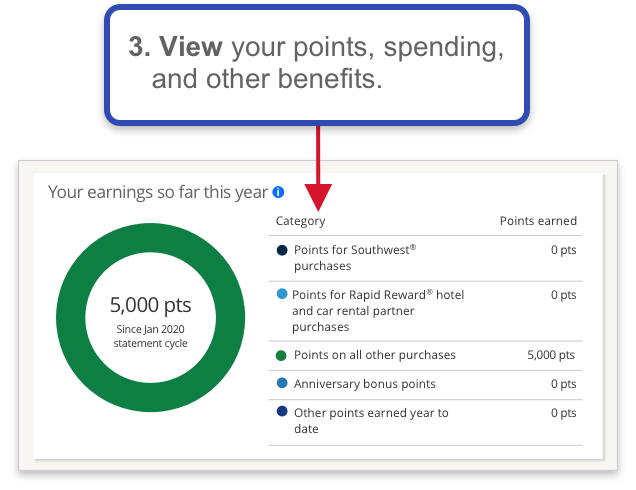

Rewards Dashboard for your Southwest Rapid Rewards Credit Card.As a Southwest Rapid Rewards Cardmember, you can now keep track of all the points you've earned so far this year with your card. You can also see the benefits and perks that come with your card.

Find your Rewards Dashboard by viewing your Southwest Rapid Rewards Credit Card account on Chase.com:

Illustrative Example Only

Earn 1,500 tier qualifying points (TQPs) toward A-List status for every $5,000 spent in purchases annually. footnote reference *

Companion Pass is the benefit that allows you to choose one person to fly with you, free of airline charges (does not include taxes and fees from $5.60 one-way) every time you purchase or redeem points for a flight. All points earned with your Rapid Rewards Credit Card count toward Companion Pass.

Remember, as an exclusive benefit, Rapid Rewards Credit Cardmembers will receive a boost of 10,000 Companion Pass qualifying points every year.

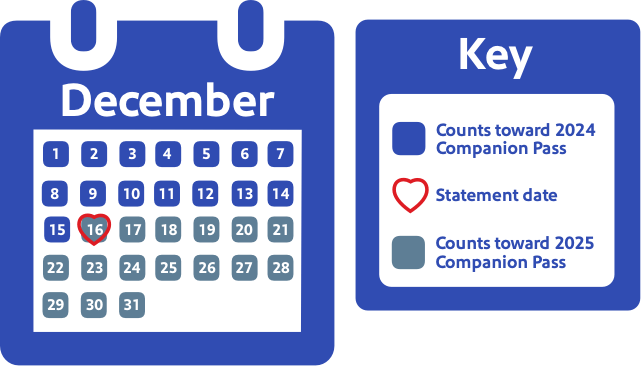

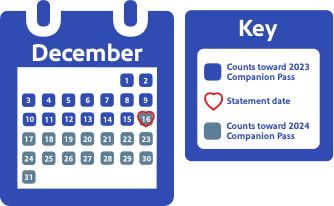

Your December statement closing date is the cutoff for purchases made with your Rapid Rewards Credit Card to count towards a Companion Pass for that calendar year.

For example, if your December statement closes on December 16, points for purchases posted to your statements made after that date will not count toward qualifying points for the year.

Use your card while enjoying added protection and peace of mind as you travel and shop in confidence.

start of table chart Travel and Purchase protection benefits header row header column one blank header column two Visa Signature header column three Visa Platinum![]()

row one column one Auto Rental Collision Damage Waiver opens overlay

row one column two Visa Signature

row one column three Visa Platinum

![]()

row two column one Roadside Dispatch opens overlay

row two column two Visa Signature

row two column three Visa Platinum

![]()

row three column one Purchase Protection opens overlay

row three column two Visa Signature

row three column three Visa Platinum

![]()

row four column one Extended Warranty Protection opens overlay

row four column two Visa Signature

row four column three Visa Platinum

![]()

row five column one Lost Luggage Reimbursement opens overlay

row five column two Visa Signature

row five column three Visa Platinum

![]()

row six column one Baggage Delay Insurance opens overlay

row six column two Visa Signature

row six column three Visa Platinum

![]()

row seven column one Travel and Emergency Assistance Services opens overlay

row seven column two Visa Signature

row seven column three Visa Platinum

![]()

row eight column one Travel Accident Insurance opens overlay

row eight column two Visa Signature

coverage up to $500,000

row eight column three Visa Platinum

coverage up to $500,000

We’ve made it simple to turn your recent annual fee payment or eligible purchases in to a statement credit. Just select the qualifying transaction that posted to your account within the last 90 days.

Choose "Rewards dashboard" from the drop-down menu under the More tab on your My Account Page.

Choose Pay Yourself Back from the top navigation bar.

Select the qualifying purchases to redeem.

From booking to landing, our goal is to make your experience a great one.Southwest ® EarlyBird Check-In ® : Each anniversary year you will be reimbursed for the purchase of up to 2 EarlyBird Check-In services made with your Southwest Rapid Rewards ® Premier Business Credit Card. Each EarlyBird Check-In service means a purchase made for EarlyBird Check-In one-way, per Passenger. Anniversary year means the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that each year. If you switch to this product from another Chase credit card, your account open date is the date the switch to the Southwest Rapid Rewards ® Premier Business Credit Card is completed. EarlyBird Check-In provides automatic check-in before the traditional 24-hour check-in and can be purchased as part of the original flight purchase or added to a flight after purchase. Price of EarlyBird Check-In may vary. Statement credit(s) will post to your account the same day your purchase posts to your account and will appear on your monthly credit card billing statement within 1-2 billing cycles. Account must be open and not in default at the time the statement credit is posted to your account. Statement credits will be issued for the anniversary year in which the transaction posts to your account. For example, if you purchase EarlyBird Check-In and Southwest does not post the transaction until after your current anniversary year ends, the cost of the EarlyBird Check-In services will be allocated towards the following year’s maximum of 2 services. More information can be found at opens overlay Southwest.com/early-bird.

25% back on inflight purchases on Southwest Airlines ® flights: You will receive 25% back on Southwest Airlines inflight purchases made with your Southwest Rapid Rewards ® Premier Business Credit Card for drinks and WiFi in the form of a credit card account statement credit. Statement credit(s) will post to your credit card account the same day as your purchase(s) and will appear on your monthly credit card billing statement within 1-2 billing cycles. You will also receive 25% back on inflight purchases made by employees on your account. To qualify for the 25% back, purchase must be made with your Southwest Rapid Rewards ® Premier Business Credit Card and your account must be open and not in default at the time of fulfillment.

Companion Pass Qualifying Points: Companion Pass ® qualifying points are earned from revenue flights booked through Southwest ® , points earned on Rapid Rewards ® Credit Cards, and base points earned from Rapid Rewards partners. The following do not count as Companion Pass qualifying points: purchased points; points transferred between Members; points converted from hotel and car loyalty programs, e-Rewards ® , Valued Opinions, and Diners Club ® ; points earned from Rapid Rewards program enrollment, tier bonus points; flight bonus points; and partner bonus points (with the exception of the Rapid Rewards Credit Cards from Chase). No points nor tier or Companion Pass qualifying points will be awarded for flights taken by the Companion when flying on a Companion Pass reservation. Points earned during a billing cycle on a Southwest Airlines Rapid Rewards Credit Card from Chase are not available for redemption or qualification for Companion Pass status until they are posted on your billing statement and posted to your Rapid Rewards account. Only points posted on your billing statements and posted to your Rapid Rewards account during the same calendar year are available for qualification for Companion Pass status. For example, if you make a purchase after your December billing statement cycle date, the points on those purchases will not count toward Companion Pass status in the year the purchase was made; they will appear on your January billing statement and post to your Rapid Rewards account in January. Companion Pass Qualifying Points Boost: As a Southwest Rapid Rewards Cardmember, you will earn one boost of 10,000 Companion Pass qualifying points each calendar year. The boost will be deposited into your eligible Rapid Rewards account by January 31st each calendar year or up to 30 days after account opening. To receive Companion Pass qualifying points boost your credit card account must be open and not in default at the time of fulfillment. Only one credit card account per Southwest Rapid Rewards Member (Rapid Rewards Member must be the primary Cardmember on that account), is eligible for one boost of 10,000 Companion Pass qualifying points per calendar year. JPMorgan Chase Bank, N.A. is not responsible for the provision of, or failure to provide, the stated benefits and services.

Tier Qualifying Points: Tier qualifying points (TQPs) are earned from revenue flights booked through Southwest Airlines ® or when you, or an employee, use the Southwest Rapid Rewards ® Premier Business Credit Card from Chase to make purchases of products and services, minus returns or refunds. (You’ll earn 1,500 for each $5,000 in purchases annually. “Annually” means the year beginning with your account open date through the first December statement date of that same year, and each 12 billing cycles starting after your December statement date through the following December statement date.) TQPs earned during a billing cycle on a Southwest Rapid Rewards ® Premier Business Credit Card from Chase are not available for qualification for benefits such as A-List and A-List Preferred status until they are posted to your Rapid Rewards ® account. The following will not count toward qualification for A-List or A-List Preferred status: Rapid Rewards program enrollment points; Rapid Rewards reward flights; Rapid Rewards Companion Pass ® travel; Rapid Rewards partner points except for TQPs earned on the Southwest Rapid Rewards ® Premier Business Credit Card from Chase; Rapid Rewards bonus points, unless specifically designated as such; non-revenue travel, unless specifically designated as eligible; stops at intermediate cities on connecting or through flights; and charter flights. TQPs are not redeemable for travel on Southwest ® or through the “More Rewards” site.

Southwest ® $500 Fee Credit for Points Transfers: A statement credit will automatically be applied to your account as reimbursement for fees associated with using your Southwest Rapid Rewards ® Premier Business Credit Card to transfer points to another Rapid Rewards Member or a pre-selected charity chosen by Southwest with an active Rapid Rewards account, up to an anniversary year maximum accumulation of $500 in reimbursed transfer fees. Anniversary year means the year beginning with your account open date through the first statement date after your account open date anniversary, and the 12 monthly billing cycles after that date each year. If you switch to this product from another Chase credit card your account open date is the date the switch to the Southwest Rapid Rewards ® Premier Business Credit Card is completed. Statement credit(s) will post to your account the same day your point transfer fee purchase posts to your account and will appear on your monthly credit card billing statement within 1-2 billing cycles. Account must be open and not in default at the time the statement credit is posted to your account. Statement credits will be issued for the anniversary year in which the transaction posts to your account. For example, if you transfer points and Southwest does not post the fee transaction until after your current anniversary year ends, the cost of the fee will be allocated towards the following year’s maximum of $500 in reimbursed transfer fees. Points can be transferred with a minimum transfer of 2,000 points and a daily maximum of 60,000 points.

Earning Points: Rewards Program Agreement: For more information about the Rapid Rewards ® Premier Business Card rewards program, view the latest opens in a new window Rewards Program Agreement (PDF). If you are a Chase Online customer, your Rewards Program Agreement is available after logging in to chase.com. You can also see your Rewards Program Agreement that you received in the mail.

How you can earn points: You’ll earn points on purchases of products and services, minus returns or refunds, made with a Rapid Rewards ® Credit Card by you or an authorized user of the account. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won’t count as a purchase and won’t earn points: balance transfers, cash advances and other cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. 3 points: You’ll earn 3 points for each $1 spent on purchases made directly with Southwest Airlines ® , including flight, inflight, Southwest ® gift card, and Southwest Vacations ® package purchases. 2 points: You’ll earn 2 points for each $1 spent on purchases at participating Rapid Rewards ® hotel and rental car partners. 2 points: You’ll earn 2 points for each $1 spent on purchases in the local transit and commuting rewards category. 1 point: You’ll earn 1 point for each $1 spent on all other purchases. 1 point on balance transfers: You’ll earn 1 point for each $1 of the first $15,000 of balance transfers made during the first 90 days from your original account open date. 6,000 bonus points each account anniversary year: You’ll receive 6,000 bonus points each account anniversary year. “Account anniversary year” means the year beginning with your account open date through the anniversary of your account open date, and each 12 months after that. 1,500 tier qualifying points: You’ll earn 1,500 tier qualifying points (TQPs) for each $5,000 spent in purchases annually. TQPs can be used to count toward qualification for Rapid Rewards A-List or A-List Preferred status. “Annually” means the year beginning with your account open date through the first December statement date of that same year, and each 12 billing cycles starting after your December statement date through the following December statement date. Information about earning/transferring points to Southwest Airlines ® : Points earned during a billing cycle will be automatically transferred to Southwest Airlines after the end of each billing cycle. Losing points: You’ll immediately lose all points that haven’t been transferred to Southwest Airlines if your card account status changes, or your card account is closed for program misuse, fraudulent activities, failure to pay, bankruptcy, or other reasons described in the terms of the Rewards Program Agreement. Rewards Categories: Merchants who accept Visa/Mastercard credit cards are assigned a merchant code, which is determined by the merchant or its processor in accordance with Visa/Mastercard procedures based on the kinds of products and services they primarily sell. We group similar merchant codes into categories for purposes of making rewards offers to you. Please note: We make every effort to include all relevant merchant codes in our rewards categories. However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category. When this occurs, purchases with that merchant won’t qualify for rewards offers on purchases in that category. Purchases submitted by you, an authorized user, or the merchant through third-party payment accounts, mobile or wireless card readers, online or mobile digital wallets, or similar technology will not qualify in a rewards category if the technology is not set up to process the purchase in that rewards category. For more information about Chase rewards categories, see opens in a new window chase.com/RewardsCategoryFAQs.

Adding An Employee Card: If any employees are allowed to use the account, they will be authorized users and will have equal charging privileges unless individual spending limits are established for them. You, as the Authorizing Officer, together with the business are responsible for any use of the account by you, an authorized user or anyone else permitted to use the account. You, together with the business, are responsible for repaying all balances on the account. All correspondence, including statements and notifications, will be sent to you as the Authorizing Officer. By requesting to add an employee cardholder to the account, you represent all information provided is accurate and is for persons with which the business has a relationship. You also represent that the business has permission to provide the employee information to Chase and to add the employee as a cardholder. If Chase determines any information provided is fraudulent, Chase has the right to close the account.

Priority Check In And Security Lane Access: For a complete list of available Fly By ® locations, visit opens overlay Southwest.com/flyby.

Same-Day Standby: If there’s an open seat on a different flight that departs on the same calendar day as your original flight and it’s between the same cities, A-List and A-List Preferred Members can get a seat on the new flight free of airline charges. If there isn’t an open seat on this different flight, you can ask a Southwest Gate Agent to add you to the same-day standby list for a flight between the same city pairs that departs on the same calendar day prior to your originally scheduled flight, and you will receive a message if you are cleared on the flight. For both the same-day change and same-day standby benefits, you must change your flight or request to be added to the same-day standby list at least 10 minutes prior to the scheduled departure of your original flight or the no-show policy will apply. Based on the flight status contact preference selected during booking, the message regarding your standby status will be an email or text message with a link to access the boarding pass via the Southwest app, mobile web, or you can visit a Southwest Gate Agent to print off the boarding pass. If there are any government taxes and fees associated with these itinerary changes, you will be required to pay those. Your original boarding position is not guaranteed. Important: These benefits are available only by seeing a Southwest Gate Agent or calling 1-800-I-FLY-SWA ® . If you change your flight through any other channel or to a flight that does not meet the requirements outlined above, you will be responsible for the difference in price. If an A-List or A-List Preferred Member is traveling on a multiple-Passenger reservation, same-day standby and same-day change will not be provided for non-A-List or non-A-List Preferred Members in the same reservation. For A-List and A-List Preferred Members who have also qualified for a Companion Pass ® , A-List, and A-List Preferred benefits are not available to the Companion unless the Companion is also an A-List or A-List Preferred Member.

Travel And Purchase Protection: These benefits are available when you use your card. Restrictions, limitations and exclusions apply. Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the administration and claims. There are specific time limits and documentation requirements. Please refer to your Guide to Benefits for a full explanation of coverages, or call the number on the back of your card for assistance.

Redeem Southwest Rapid Rewards ® Points With Pay Yourself Back ® : Points may be redeemed for a statement credit using Pay Yourself Back for qualifying transactions made within the 90 days before the redemption request date. Categories and qualifying transaction eligibility may change from time to time without notice. Redemptions require a minimum of 1 Rapid Rewards Point. Chase has the right to change redemption values at any time. Statement credits will post to the card account within 7 business days of a request to redeem and will appear on the monthly Chase credit card billing statement within 1-2 billing cycles. Statement credits will reduce your balance but you are still required to make at least your minimum monthly payment. Chase reserves the right to determine which purchases qualify for a statement credit. Pay Yourself Back may be discontinued at any time.

Bags Fly Free: First and second checked bags. Weight and size limits apply.

No Blackout Dates And Unlimited Reward Seats: No blackout dates and unlimited reward seats apply to flights booked with points.

No Change Fees: Fare difference may apply.

Free live TV: Available only on WiFi-enabled aircraft. Limited-time offer. Where available. To view movies and select on-demand TV content, download the Southwest app from the Google Play Store or Apple App Store before your flight.

SOUTHWEST RAPID REWARDS ® PROGRAM INFORMATION

The Southwest Rapid Rewards Credit Card is brought to you by Southwest Airlines ® and Chase. Southwest Airlines is responsible for the redemption of Rapid Rewards points toward benefits and services. The number of points needed for a particular Southwest flight is set by Southwest ® and will vary depending on destination, time, day of travel, demand, fare type, point redemption rate, and other factors, and are subject to change at any time until the booking is confirmed. Rapid Rewards points can only be transferred to the primary Cardmember’s Rapid Rewards account. All Rapid Rewards rules and regulations apply and can be found at opens overlay Southwest.com/rrterms. Southwest reserves the right to amend, suspend, or change the program and/or program rules at any time without notice. Rapid Rewards Members do not acquire property rights in accrued points.