Sarah Harris is a professional researcher and writer specializing in legal content. An Emerson College alumna, she holds a Bachelor of Science in Communication from the prestigious Boston institution.

Hannah Locklear is SoloSuit’s Marketing and Impact Manager. With an educational background in Linguistics, Spanish, and International Development from Brigham Young University, Hannah has also worked as a legal support specialist for several years.

George Simons is the co-founder and CEO of SoloSuit. He has helped Americans protect over $1 billion from predatory debt lawsuits. George graduated from BYU Law school in 2020 with a JD/MBA. In his spare time, George likes to cook, because he likes to eat.

Summary: Settling your debt is possible. You can draft your own debt settlement letter using our sample letter below, or start the debt negotiation process with SoloSettle to get the ball rolling on settling your debt.

Is a debt collector pursuing you for an old debt you wish was long behind you? If so, you may try to settle the obligation. Under debt settlement, you agree to pay a certain amount to the collection agency. In exchange, the collection agency accepts your payment and writes off the remaining balance.

Debts settle for 48% of the original value if the matter has not escalated to litiation yet. If there is a lawsuit filed over the debt, the average debt settlement amount increases to 85%. Collection agencies are usually more willing to accept a settlement if your debt is old and past the statute of limitations.

Collection agencies cannot sue you for a debt that passes the statute of limitations. The statute of limitations will vary depending on your state but generally ranges from two to five years.

To get the ball rolling on settling your debt, you’ll want to send the collection agency a written offer for settlement.

Debt settlement is when you negotiate with your creditor and come to agreement to pay off a portion of your debt and be forgiven for the rest. Debt settlement letters are known to help start the negotiation process.

You’ll want to include specific information concerning your account in your debt settlement letter.

List your name, account information, the original creditor of the debt, and the debt collection agencies identifying information. Include the current amount you owe and the amount you’d like to offer to settle the debt.

Most importantly, request a debt settlement agreement letter that declares the debt will be reported as paid to all the credit reporting bureaus once you’ve fulfilled your side of the agreement. To summarize, include these points in your debt settlement letter:

Your offer to settle the debt should be clear and straightforward. It should express that you’re willing to offer partial payment to eliminate the obligation.

60% is a good place to start, but the amount varies based on your financial situation and the collection agency who is suing you.

Like we mentioned before, the average debt settlement is 48% for pre-lawsuit debts and 85% for debt lawsuits, but note that each debt circumstance is unique. In our experience, however, debt collectors and law firms are more likely to accept a settlement of around 70%.

Most collection agencies purchase old debts from creditors for a small fraction of their original value. It’s not uncommon for collectors to pay only 5 or 10% of a debt in exchange for the right to pursue collection activities against you.

Let's look at a debt settlement example.

Example: If you have an old credit card balance of $5K with JP Morgan and decide to sell it to a debt collector, the collection agency may pay only $250 to $500 for your balance. JP Morgan will provide the collector with basic information about your account, like your contact details and the balance due. Once the collection agency owns your account, they’ll send you letters and start calling you to obtain the original value you owe. You can stop further collection activity by offering to settle the debt for a fair price. Offer what you feel you can afford to pay and see if the collection agency is willing to accept.

You might be wondering how to write a good settlement offer letter. We’ve got you covered.

SoloSettle uses a tech-based approach to draft and send settlement offers to creditors and debt collectors. The offer letter includes all the important legal wording necessary to protect your rights and show collectors that you know your stuff.

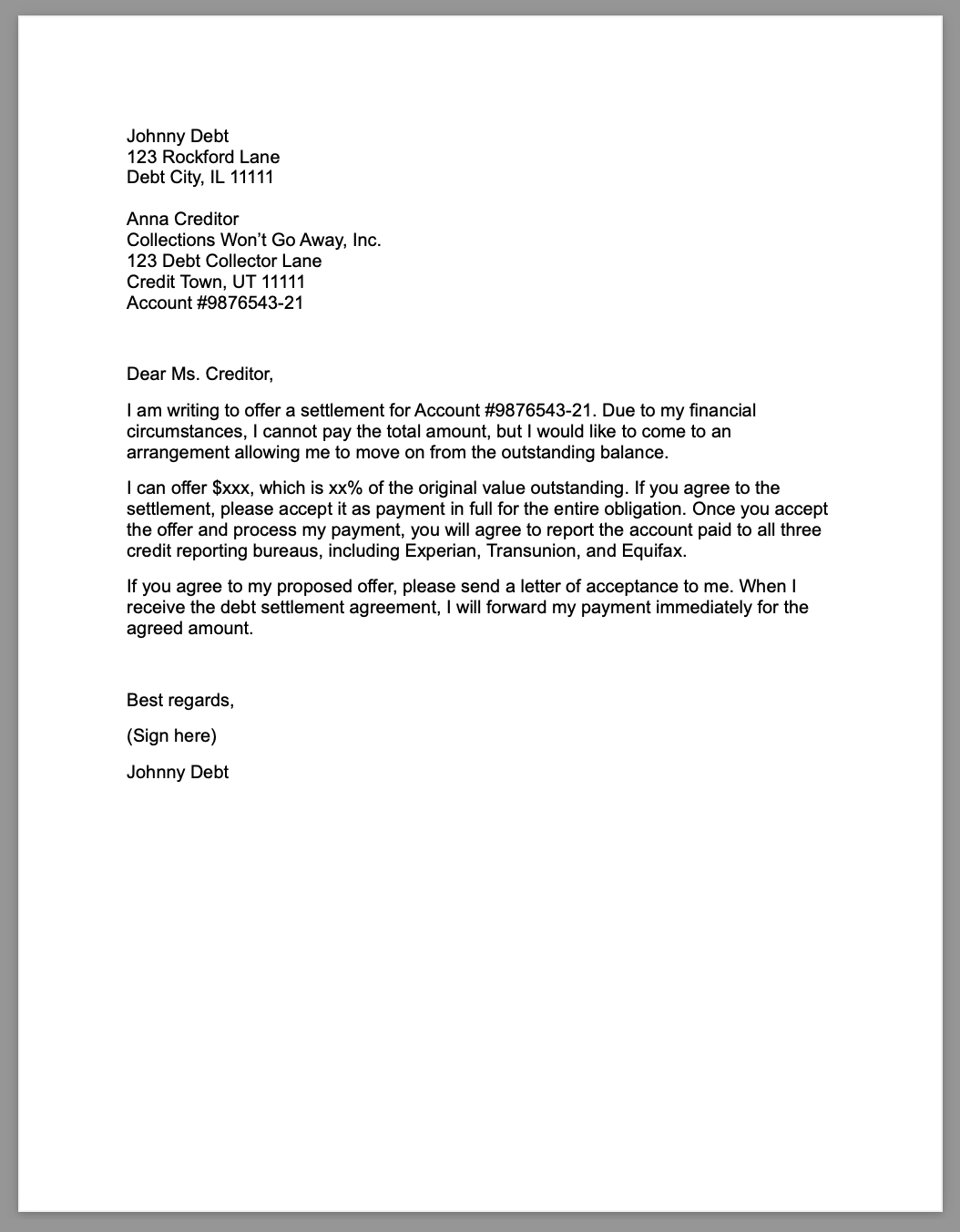

Alternatively, you can use this settlement sample letter to help you draft one on your own:

No, they do not have to accept your offer. However, most collection agencies are willing to take less for your obligation, especially if they don’t think you’ll be able to pay the entire amount.

If the collection agency believes they have grounds to sue you for the debt in court, they may pursue a lawsuit against you. If that is the case, you can still potentially settle the account on your own with the help of SoloSettle.

In most cases, working with a collection agency can prevent your account from snowballing into a lawsuit. Debt collectors are often willing to come to a favorable arrangement if you initiate the process, even if it’s before they take you to court. You’ll be able to move on without fear of harassing phone calls or stressful letters.

SoloSettle’s goal is to empower you to negotiate and reach a debt settlement on your own.

With SoloSettle, negotiating a settlement becomes easy due to our structured process. Use our web-app to send and receive offers from collectors. SoloSettle drafts offers for you and protects you from the potential lies and bullying of debt collectors.

Most importantly, SoloSettle makes sure all of the proper legal language is included to protect your rights when communicating with the creditor or debt collector. When a settlement agreement is reached, SoloSettle manages the settlement agreement documentation for you and protects your sensitive financial information from the collectors, preventing them from over-charging you.

Avoid working with debt settlement companies, who don’t always have your best interest at heart.

Check out this review from a real SoloSettle customer:

“I'm very thankful for SoloSettle. Having a third party negotiate the settlement was instrumental in resolving this case and saved me from two giant headaches: 1) I didn't have to deal with the plaintiff's lawyer and 2) I didn't have to go to court. I also love that the payment was processed through SoloSettle. I was nervous about sharing my personal financial data with the other side, but SoloSettle protected that for me. I hope I never get sued again, but if I do, I would use SoloSettle again in a heartbeat. SoloSettle really saved me a ton of time and heartburn and kept me from having to be my own lawyer in court.” - Dan

Check out this video to learn more about how to settle a debt:

SoloSuit makes it easy to fight debt collectors.

You can use SoloSuit to respond to a debt lawsuit, to send letters to collectors, and even to settle a debt.

SoloSuit's Answer service is a step-by-step web-app that asks you all the necessary questions to complete your Answer. Upon completion, we'll have an attorney review your document and we'll file it for you.